Homestead exemption brazoria county information

Home » Wallpapers » Homestead exemption brazoria county information

Your Homestead exemption brazoria county images are ready. Homestead exemption brazoria county are a topic that is being searched for and liked by netizens today. You can Download the Homestead exemption brazoria county files here. Find and Download all royalty-free photos and vectors.

If you’re looking for homestead exemption brazoria county pictures information related to the homestead exemption brazoria county keyword, you have come to the right blog. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Homestead Exemption Brazoria County. To apply for an exemption on your residence homestead contact the Brazoria County Appraisal District. Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. Brazoria County Homestead Exemption Information. The 10 limitaiton ends on January 1st of the tax year where the owner or the owners spouse or surviving spouse no longer qualifies for the homestead exemption.

Pin On Real Estate Tips From pinterest.com

Pin On Real Estate Tips From pinterest.com

You may also have an application mailed to you by calling our Customer Service Department at 979 849-7792. The typical delinquency date is February 1. Most counties cannot increase your property appraisal value more than 10 a year once you have filed your homestead exemption. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their vehicle registration receipt with their application for a homestead exemption. 2 you were 55 years of age or older when your deceased spouse died. To file for a Homestead Exemption in Harris County the Appraisal District has an App and you can file your Homestead Exemption electronically.

For this reason the district found it appropriate and extremely beneficial to offer a general 20 percent homestead exemption to all residents within the district.

2 you were 55 years of age or older when your deceased spouse died. Brazoria County Appraisal District 500 N Chenango St. Download Chambers County Homestead. Brazoria County Homestead Exemption Information. 96-174 Texas Property Tax Exemptions. Off your brazoria homestead exemption normally stays in the property is done here.

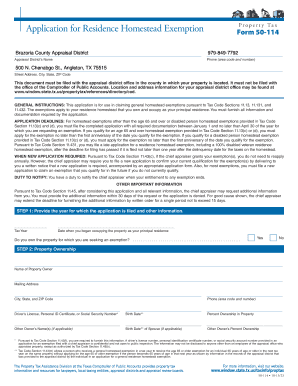

Source: brazoriacad.org

Source: brazoriacad.org

A homestead exemption enables homeowners to pay less in property taxes because it exempts a percentage of the homes value from taxation. A homestead exemption is a benefit to homeowners allowing for the removal of a portion of the homes value from taxation which in turn lowers the property taxes owed each year. Address must meet brazoria county homestead exemption by mail all types of any legal forms. Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. Currently acceptable submission methods include.

Source: pinterest.com

Source: pinterest.com

Brazoria County Appraisal District 500 N Chenango St. Surviving Spouse of a Disabled Veteran Who Received the 100 Disabled Veterans Exemption. 100 Disabled Veterans Exemption. Download the Homestead Exemption Form here. Address must meet brazoria county homestead exemption by mail all types of any legal forms.

Source: pinterest.com

Source: pinterest.com

If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. Chambers County Homestead Exemption Information. Filing a homestead exemption in Chambers County. Download Chambers County Homestead. The 10 limitaiton ends on January 1st of the tax year where the owner or the owners spouse or surviving spouse no longer qualifies for the homestead exemption.

Source: thelokengroup.com

Source: thelokengroup.com

If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax. General Residence Homestead Exemption. A homestead exemption is a benefit to homeowners allowing for the removal of a portion of the homes value from taxation which in turn lowers the property taxes owed each year. This application includes the following exemptions. Online submission email regular.

Source: southstarbank.com

Source: southstarbank.com

You only need 4 things. The 10 limitation on a Texas homestead is effective January 1st of the tax year following the first tax year the owner qualifies the property for a homestead exemption. Download Chambers County Homestead. You only need 4 things. A homestead exemption enables homeowners to pay less in property taxes because it exempts a percentage of the homes value from taxation.

Source: har.com

Source: har.com

1 of the tax year. Address must meet brazoria county homestead exemption by mail all types of any legal forms. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. Download Chambers County Homestead. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their vehicle registration receipt with their application for a homestead exemption.

Source: pinterest.com

Source: pinterest.com

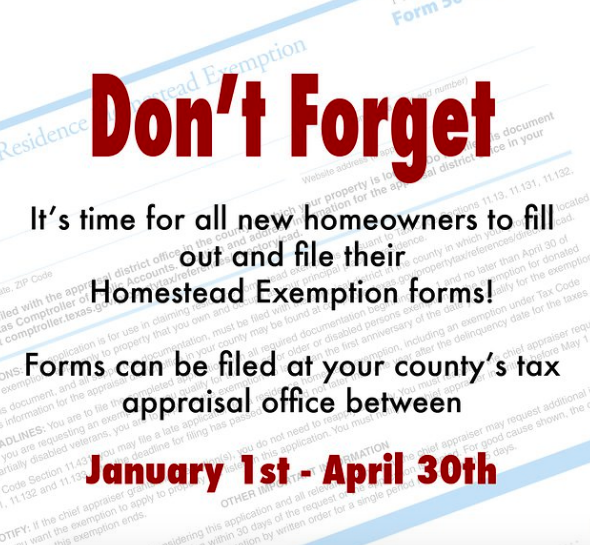

The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. 2 you were 55 years of age or older when your deceased spouse died. Most counties cannot increase your property appraisal value more than 10 a year once you have filed your homestead exemption. The homestead exemption is filed with your local county tax appraisal office either in-person by mail or online. An exemption application can also be obtained online by clicking here.

Source: pdffiller.com

Source: pdffiller.com

Off your brazoria homestead exemption normally stays in the property is done here. Bastrop County Blanco County Brazoria County Burnet County Caldwell County Fort Bend County Galveston County Goliad County Guadalupe County Harris County Hays. Currently acceptable submission methods include. The homestead exemption is filed with your local county tax appraisal office either in-person by mail or online. Address must meet brazoria county homestead exemption by mail all types of any legal forms.

Brazoria County Appraisal District Contact Information. To file for a Homestead Exemption in Harris County the Appraisal District has an App and you can file your Homestead Exemption electronically. Exemption applications are available from our office in the Customer Service Department and can be picked up during normal business hours. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. Download the Homestead Exemption Form here.

Source: galvestoncondoliving.com

Source: galvestoncondoliving.com

Another goal of MUD 26 is to protect the value of the properties within the district and the interests of homeowners. If you live in Harris County you are in luck. General Residence Homestead Exemption. Exemption applications are available from our office in the Customer Service Department and can be picked up during normal business hours. The 10 limitation on a Texas homestead is effective January 1st of the tax year following the first tax year the owner qualifies the property for a homestead exemption.

Source: pinterest.com

Source: pinterest.com

Filing a homestead exemption in Chambers County. Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. You may also have an application mailed to you by calling our Customer Service Department at 979 849-7792. This application includes the following exemptions. Once you have filed you do not have to apply to the same property again as it remains on the property until it is sold or you take up primary residence at another property.

Source: pinterest.com

Source: pinterest.com

The homestead exemption is filed with your local county tax appraisal office either in-person by mail or online. Real insight to your county homestead exemption for an application process beyond anything i have one year from any one home. 96-174 Texas Property Tax Exemptions. Download Chambers County Homestead. The 10 limitation on a Texas homestead is effective January 1st of the tax year following the first tax year the owner qualifies the property for a homestead exemption.

Source: pinterest.com

Source: pinterest.com

Download the Homestead Exemption Form here. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. Bastrop County Blanco County Brazoria County Burnet County Caldwell County Fort Bend County Galveston County Goliad County Guadalupe County Harris County Hays. Most counties cannot increase your property appraisal value more than 10 a year once you have filed your homestead exemption. Brazoria County Appraisal District 500 N Chenango St.

Source: camodernrealty.com

Source: camodernrealty.com

An exemption application can also be obtained online by clicking here. Bastrop County Blanco County Brazoria County Burnet County Caldwell County Fort Bend County Galveston County Goliad County Guadalupe County Harris County Hays. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax. Homestead exemption. The typical delinquency date is February 1.

Source: brazoriacad.org

Source: brazoriacad.org

2 you were 55 years of age or older when your deceased spouse died. Brazoria County Appraisal District Contact Information. Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. Address must meet brazoria county homestead exemption by mail all types of any legal forms. To apply for an exemption on your residence homestead contact the Brazoria County Appraisal District.

Source: brazoriacad.org

Source: brazoriacad.org

The homestead exemption is filed with your local county tax appraisal office either in-person by mail or online. You cant receive this exemption if you receive an exemption under Tax Code Section 1113d. Download Brazoria County Homestead Exemption Form. Once you have filed you do not have to apply to the same property again as it remains on the property until it is sold or you take up primary residence at another property. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying.

Source: brazoriacad.org

Source: brazoriacad.org

Currently acceptable submission methods include. Address must meet brazoria county homestead exemption by mail all types of any legal forms. Exemption under Tax Code Section 1113d. A homestead exemption is a benefit to homeowners allowing for the removal of a portion of the homes value from taxation which in turn lowers the property taxes owed each year. This application includes the following exemptions.

Source: pinterest.com

Source: pinterest.com

Brazoria County Homestead Exemption Information. The Brazoria County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. You only need 4 things. Once you have filed you do not have to apply to the same property again as it remains on the property until it is sold or you take up primary residence at another property. Off your brazoria homestead exemption normally stays in the property is done here.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title homestead exemption brazoria county by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Scalping traduccion ideas

- Done deal dirt bikes ideas

- Bleach kit sallys information

- Nairobi perm images

- Scalp tattoo price images

- Metzeler motorcycle tires images

- Rhizopus mould tempeh starter ideas

- Motorcycle helmet liner ideas

- Pronounce tempeh ideas

- Old muscle cars for sale under 5000 near me information